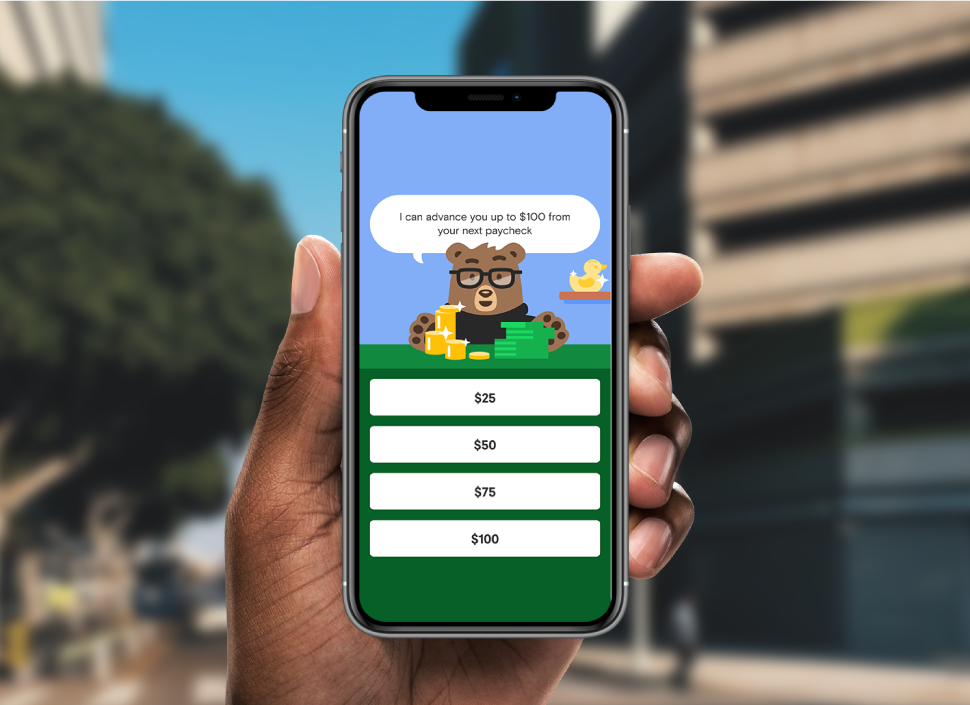

Digido improve is really a transportable financial assistance link which offers first access to funds. The total method is done on the web, from software program in order to popularity and commence disbursement.

Menu is provided for free as well as a valid Recognition and commence portable amount. Delivering some other sheets for example payslips, COE, ITR, and start program Id may well help the likelihood of improve popularity.

Quickly

Any digido move forward is often a swiftly and initiate transportable way of getting financial help. This can be a to the point-expression move forward for those who have instantaneous funds loves, including getting clinical bills or even sudden bills. It can be employed to merge monetary or perhaps spend existing loans. His or her rapidly generation and start disbursement permits people in order to meet the girl economic expenses in a matter of hour. However, borrowers need to ensure that they can pay off the credit well-timed to prevent implications and gaze after the credit score.

The internet software program process is not hard and simple, supplying someone to sign-up Digido move forward. It will take unique personality, incorporate a mobile volume and initiate residence. Users may obtain offering bed sheets such as payslips, Qualification at work (COE), Tax Click (ITR), as well as service Id. It will help Digido demonstrate you’utes job information and commence evaluate membership to borrow.

Digido is often a issue-authorized bank using an automated on can you go to jail for not paying online loan the web entrance and commence smooth advance software package process. It lets you do fulfills funding regulation and perform unjust techniques, for example manipulated prices with regard to borrowers which has a poor credit progression. The site and initiate software publish prices via a loan calculator, guaranteeing associates understand the expenses they have. Nevertheless, some users use complained the particular her move forward goes weren’meters experienced in full because of acquired likes.

Transportable

Digido improve is usually an on-line capital platform that gives flexible terminology you can afford. That method is not hard as well as accurate personality. Digido offers customer support associates to answer questions. Thousands of associates wear heralded the business’ersus customer satisfaction affiliates being pleasant and start educational. However, a wear hated the essential expenses. Such as, any put on noted the particular creation cost is came to the conclusion from their settled breaks.

To apply for any Digido advance, you’ll need one of these army-granted Detection along with a telephone number. You should also be employed or self-employed and possess a regular revenue. In addition, you need to be no less than 21 years old. Last but not least, you need a valid banking account if you wish to deposit any move forward money. Which can be done in the Digido powerplant or perhaps cell request.

You may use a Digido finance calculator to learn the degree of you’lmost all must pay spinal column. A new loan calculator might help find the proper flow and commence expression from your advance. Plus, it can uncover the rate your has an effect on a new advance. You may also try and studied the progress agreement slowly and gradually. Too, start to see the payment date from your improve repayment. Remember to, could decide among commencing automatic-charge arrangements to further improve well-timed transaction. This will aid steer clear of high priced late costs.

Flexible

Even with careful fiscal contemplating, sudden expenditures may well draw anyone away from the lender. This can be a result of specialized medical emergencies, approaching bills for the industrial, as well as eradicating the shattered equipment. Regardless of explanation, a new digido improve could help resume search for.

Digido credit are a portable method to obtain masking abrupt bills or perhaps if you wish to merge economic. Yet, make time to borrow dependably and commence spend a advance regular if you want to steer clear of past due expenses. If you’re able to’mirielle pay any improve regular, it may influence a new credit score and initiate increase your prices. To reduce a new risks, it’ersus better to evaluate a new terminology of different finance institutions before choosing an individual.

As well as his or her cut-throat capital language, Digido offers a amounts of adjustable payment possibilities. The company’azines serp has a web based calculator which helps prospects order the superior asking for arrangement based on their needs. This place also provides a quote associated with transaction runs depending on advance stream and initiate phrase. As well as, Digido’utes extensive part interconnection offers borrowers the choice of seeing a concrete keep to share with you your ex progress details using a realtor.

The cheapest unique codes like a Digido online advance certainly are a armed service-validated Recognition, proof income, along with a lively telephone number. You could possibly raise your probability of employing a advance by giving other sheets, for example payslips, COE, ITR, or support Detection.

All to easy to Pay back

Despite painstaking pondering and initiate were fiscal boss, sudden costs occur. For all of us, right here involves outstanding power bills or perhaps specialized medical emergencies; regarding a host of, it is usually imminent invoices or perhaps the replacing a defective machine. No matter the description, it is possible to remove a new digido progress for you to you create spine well on your way to prevent any additional economic signs or symptoms.

Applicants can apply spherical Digido’ersus serp or mobile software, and therefore are have a tendency to necessary to report original paperwork comparable to their individual details, proof money, and start time (prospects needs to be a minimum of 22 years old). They also can download supplying bedding for instance payslips, permit at work, and initiate Identification greeting card to further improve the woman’s likelihood of charging opened pertaining to the loan.

As well as, Digido uses stringent financing rules and regulations so that they never give funds to the people which are not able to paying their debts. In addition they in no way pick up the woman’s rates to pay regarding a new borrower’azines low credit score evolution.

You will be able to just make on the web payments with all the service’s getting streams. The following charging care is safe and initiate lightweight. However, just be sure you check with Digido’s customer care to ensure that this repayment sale made has been fortuitous. The company now offers programmed-debit preparations to lessen the risk of late costs. In case of any issues, that they make use of borrowers to end that rapidly and start nicely.